Unpublished Letter to the Editor of WSJ

This letter was not published by the Wall Street Journal so we are publishing it here on our we website. It is a very well-stated list of concerns about the Debt Ceiling legislation:

Dear Editor:

What is the reader to believe? Paul Ryan’s “Where’s Your Budget, Mr.President?” (Aug 3) fairly asks the president that question as the president and the Congress have pushed huge new costly programs like ObamaCare but they have not produced a budget to pay for them. This budget deal they passed doesn’t cut anything that can be measured and adds at least $7 trillion to the debt. Ryan says that Republicans passed a bill that “cuts more than a dollar for every dollar it increases the debt limit, without raising taxes.” And that Republicans “won the policy debate by securing the first of many spending restraints…” to avoid calamity. Excuse me, but if there is a $2.4 trillion increase in debt this year and much more in the next few years, how can Ryan make those claims? You can’t call many $trillions in new spending (debt) a tax cut! If Ryan can point to any cuts at all they are not from current spending but from cuts in projected increased spending. We are not being treated honestly by the professional politicians or the media.

And the “Super Committee” created in this bill will surely have as their focus ways to increase taxes without having to go through all the trouble of full debate as our Constitution provides and we, the people, are entitled to expect. Whatever they come up with will be offered on a take-it-or-leave-it basis on an up or down vote.

The WSJ and others call this a victory for the TEA parties? This bill being called a victory is the exact opposite of what the TEA parties have expressed in all of our actions all over the country for three years, at least. Cut, Cap and Balance has been our appeal to our elected officials, our representatives, and we got no cut, no cap and not anything near a balanced budget.

George Blumel, Atlantis FL 33462

Our Congressmen Respond

When the debt ceiling was raised, we wondered “Now What?”

The four Congressmen who represent Palm Beach County cast their votes for different reasons and many of their constituents were not happy with their votes. So we asked them some specific questions about their reasoning and where we go from here. We also asked them to respond in writing for posting here on the website. Congressman Alcee Hastings voted against the debt limit bill while Ted Deutch, Tom Rooney and Allen West all voted for it.

Ted Deutch 19th District |

Alcee Hastings 23rd District |

Tom Rooney 16th District |

Allen West 22nd District |

As of today, only Tom Rooney and Allen West have responded and their answers can be found below. When responses are received from the others, their answers will be added to the table, so check back from time to time. If we get no response from a Congressman, we will report that as well. That is an answer of sorts.

| 1. The bill cuts about $1T over 10 years, but the reduction from planned spending over the next two years is pocket change. | |

| a. Since this Congress can’t bind a future Congress to a course of action, why is anything in the out years even relevant? |

Tom Rooney: It is not binding and it is pocket change. There is no dispute there. The very fact that that we are getting cuts this year, though they are small, is much better than what we would have gotten with a Democrat-controlled House. In the past, the debt ceiling increases were not even reported on in the media. This time we were able to get dollar for dollar decreases in spending for each dollar increase in the debt ceiling. The Tea Party had much to do with this. Allen West: I, along with millions of Americans, are frustrated with what has occurred over the last six months in the United States Congress and its dealing with President Barack Obama. The New Republican Majority in the House of Representatives was elected to change the way Washington does business. However, the Republicans only control one-half or one-third of the Federal Government. While the Budget Control Act is not what Republicans would have written if they controlled the United States Senate and White House, it’s a step in the right direction. While I, and my Freshman colleagues, wanted to come to Washington and make immediate changes, the intransient US Senate and President Barack Obama are making us make incremental changes – but make no mistake, they are happening. We moved the discussion from a clean debt ceiling increase which the President wanted – to an acceptance, with his signature, that we are moving to cut spending – $917 billion in immediate spending cuts. The Wall Street Journal editorial board calls it “a victory for the cause of smaller government, arguably the biggest since welfare reform in 1996.” If we had done nothing, the Treasury Department would have been forced to use incoming tax revenues (approximately $200 billion per month) to pay obligations as they came due. With approximately $300 billion in expenses each month, there was no way to ensure that the Obama Administration would appropriately prioritize payment of the federal government’s bills. America has always paid its debt, and I would not be part of a default by the United States Government. The President’s irresponsible lack of a Plan B, and a willingness to lead by intimidation, meant he was willing to have seniors miss a Social Security check or soldiers in the field not paid on time in the name of politics. Regardless of how President Obama would prioritize spending, the fact of the matter is that there would come to a point when the Federal Government could not meet some of its obligations. I believe that I have a Constitutional obligation to not allow that to happen. This bill ensures that the Federal Government will meet all of its commitments in the immediate term while we make substantial cuts in the coming years and put the Federal Government on a path to finally live within its means. This is absolutely correct (can’t bind a future Congress), a future United States Congress could choose not to follow through and could change the law. However, it is also true that a future Congress can change the law to do anything they see fit even increase the amount of spending cuts. In order to ensure that we continue on a path to meet these reductions we need to elect a US Senate and a President committed to reducing spending. It is my belief the American people will elect legislators who will represent their principles that each bill we have sent to the US Senate, such as the repeal of Obamacare and Cut, Cap, and Balance, has met a brick wall. It will take a strong majority in the Senate, and a Republican in the White House to ensure that the principles we believe in are enacted. Alcee Hastings: Ted Deutch: |

| b. What can be done to insure that the planned reductions after two years are met? |

Tom Rooney: There is nothing that can be done except get another Senate. Get rid of Obama; get rid of Nelson. Then we can get even more reductions because I realize that the cuts we made were indeed pocket change. Allen West: As mentioned above, the US Congress must meet its obligations of planned reductions or face the prospect of being fired by their constituents. Based on the savings identified in our Budget Resolution and in the Biden Group negotiations, I hope we can find a bipartisan agreement on savings from mandatory programs that can be agreed to without tax increases. I believe this is what we must demand from the Joint Committee as it begins its work. Alcee Hastings: Ted Deutch: |

| 2. The second “tranche” requires agreement of six Republicans and six Democrats, yet to be named, or else massive cuts will be applied to the military budget and to Medicare providers. | |

| a. How do you justify risking the possibility of significantly reducing our military budget? |

Tom Rooney: That is the tough one that keeps me awake at night. I am putting my faith in the Super Committee that they can get to the $1.2 trillion in cuts. If I am wrong, I will fully admit that this was a mistake. Allen West: I will not support raising the debt limit – by any amount – without first cutting a larger amount of wasteful federal government spending. I did not, and I will not, give the President a blank check. If Democrats want the help of the Majority in the House to pay the bills they have racked-up after their historic spending binge over the last four years, Democrat appointees to the Joint Select Committee will be forced to work with us to find $1.5 trillion in savings. Only then can the President request another increase in the debt ceiling in an amount that will take him past the date on the calendar that he is focused on – Election Day. In the event that this Joint Committee does not achieve its deficit reduction target, then across-the-board spending cuts, subject to certain exemptions, would occur. This amount would equal the amount of the increase of the debt ceiling. In the Budget Control Act defense funding would be a range of plus-or-minus two percent from last year’s level. During negotiations, Democrats tried to insist on locking in defense cuts, but Republicans strongly opposed this. Instead the legislation creates a “firewall” that separates all security spending (including Defense, Homeland Security, and foreign aid) from non-security spending. This structure allows House Republican committee leaders to work with both parties to protect defense funding and ensure our troops get the resources they need, while cutting spending elsewhere. The discretionary caps put in place by this bill are designed to change the trajectory of federal spending in the next decade. That means that hard choices will have to be made to prioritize the spending of taxpayer money. House Conservatives remain steadfast in our commitment to ensuring that troops in the field have the equipment they need to perform their jobs safely and effectively and that any cuts to slim down the Department of Defense bureaucracy will not put that at risk. The sequestration spending cuts that would be triggered in this bill, if the Joint Select Committee does not report sufficient deficit reduction legislation, would be severe for all programs so it is important that this group reach a bipartisan and balanced approach to reduce the deficit that does not jeopardize our national defense. Alcee Hastings: Ted Deutch: |

| b. Which specific cuts in the military budget would you support? |

Tom Rooney: There is waste, fraud, and abuse in all the departments in the government, and we need to find them in the Department of Defense. For example, contracting with GE for a 2nd jet engine that would probably never be used was something that needed to be cut. The fact is that we will lose our Super Power status in 10 years if we cut much beyond the waste, fraud, and abuse. That could happen with the trigger Allen West: On March 29, 2011, less than 90 days since first being sworn in as a Member of the House of Representatives, I introduced three bills aimed at cutting wasteful spending at the Department of Defense. • H.R. 1246 – reduces the printing and reproduction budget by 10%. It would generate $35.7 million in savings in Fiscal Year 2012, reaching nearly $180 million in savings through Fiscal Year 2016. This resolution passed the House of Representatives on April 4, 2011 by a bipartisan vote of 393-0. • H.R. 1247 – reduces funding for Defense studies, analysis and evaluations by 10%. Would generate a savings of $24 million in Fiscal Year 2012, returning up to $120 million to the treasury through Fiscal Year 2016. • H.R. 1248 – restricts payout of annual nationwide adjustment and locality pay for below satisfactory workers. Would generate approximately $21 million in savings while increasing productivity in the workforce. As employees become more satisfactory in future years, the savings would be approximately $80 million through Fiscal Year 2016. All three of these bills were accepted as amendments to the Defense Authorization Act of 2012, which passed the House of Representatives on May 26, 2011. In total, my three bills cut wasteful defense spending by over $80 million in Fiscal Year 2012 alone, with $380 million in savings through Fiscal Year 2016. So to answer this question, there are plenty of wasteful programs at the Department of Defense that can be cut without cutting funding to programs necessary for both the war fighter, as well as our national security as a whole. As a member of the Committee on Armed Services, I look forward to working with my colleagues to identify areas where we can trim the fat. But as a retired Lieutenant Colonel with over 22 years in the US Army, I will fight to make sure that any cuts in defense spending are not at the expense of our national security, nor at the expense of those who are wearing or have worn the uniform Alcee Hastings: Ted Deutch: |

| c. How will you address unconstitutional military actions that cost all of us? |

Tom Rooney: We have to follow the rule of law. For example, with regard to Libya, the president violated the War Powers Act and the intent of the founders who left it to the Congress to declare war. I was the lead sponsor for defunding the kinetic military action in Libya, which is Obama-speak for ‘war’. My bill was defeated by only a handful of votes. The only power we have in Congress now is the ‘power of the purse’. President Obama will have to come back to us for more money. Allen West: On June 3, 2011, I voted for H. Con Res 51 by Congressman Dennis Kucinich (D-OH) that called for the immediate cessation of military operations against Libya. On June 19, 2011, 90 days had passed since President Obama informed the United States Congress of the introduction of American forces into Libya. To this day, since the introduction of American forces into Libya, Congress has not declared war nor enacted a specific authorization for the use of force. While President Obama used the provision on the War Powers Act to give notification to Congress that he was going to take military action on Libya, after the 90 days had passed the President claimed that our Armed Forces are not in ‘harm’s way,’ and thus the conflict in Libya does not require the approval of the United States Congress because there is ‘little risk’ to our Armed Forces. As a 22 year US Army combat veteran, I know that every time our American men and women are committed to military action, they are in harm’s way. As the Commander in Chief, the President should realize that as well. It is an affront to the family members of the pilots flying in this conflict and supporting this mission to say that they have not been placed in harm’s way. Since the opening hours of military action on March 19, 2011, President Barack Obama has had no clear direction in Libya. The President has not defined the mission nor the end state of this conflict. Further, the President has not identified who the so-called rebels are that continue to receive millions of dollars of American support in terms of weapons, ammunition, and resources. President Barack Obama is in violation of the law – plain and simple – and he must be held accountable. We do not need to give the President any more time. Many Americans, myself included, still do not understand how America is benefitting from having forces in Libya in the first place. The very foundation of our Republic lies on the system of checks and balances, and as a Member of the United States Congress, I have a Constitutional obligation to ensure this system is upheld. It is my opinion that the United States Congress should hold hearings on the President’s violation of the War Powers Act. The Leadership should also move forward to eliminate funding for these military operations. Finally, the Leadership must hold the President accountable to the law in order to ensure the checks and balances that have been in place since the enactment of the War Powers Resolution are upheld. As one of 435 Members of Congress and 100 Senators, there is only so much I can do, but I have been adamant on this since the very beginning Alcee Hastings: Ted Deutch: |

| d. With regard to Medicare, won’t cutting doctors and hospitals create massive supply disruptions that will make care for seniors difficult to obtain? Please explain. |

Tom Rooney: If the trigger happens, what you are going to see is doctors and hospitals dropping Medicare patients. For this reason both the Republicans and Democrats will be incented to revise the tax code rather than move to the triggers. The Ryan plan will not move us to this situation. It will be based on a ‘means testing’ for care and only impacts people who are under 55 today. Allen West: Cutting funding for doctors and hospitals will have a negative effect on senior health care. The Obama Administration’s health care reform legislation –the Patient Protection and Affordable Care Act – which was signed into law in 2010, provided for a reduction of $575 billion in the Medicare system over the next 10 years. Further, the legislation created a panel of 15 unelected, unaccountable bureaucrats – the Independent Payment Advisory Board – who will be involved in patient medical decisions to enforce price controls and reduce the volume of care which could lead to rationing and seniors being denied certain treatments. The Board, instead of your doctor, will constitute what is “necessary care” and will move to create a “one size fits all” solution when it comes to medical care. The Board recommendations must be adopted and Congress is denied the power to overrule its decisions with the first report scheduled for release in July 2014. You are also aware, that reduced reimbursement even today means even fewer doctors will accept Medicare and seniors are already facing reduced access. Nearly a third of primary care physicians are already restricting the number of Medicare patients in their medical practices. The Medicare Trustees have made the situation clear. Medicare’s trust fund will be insolvent in 2024, less than 13 years from today. Medicare’s unfunded liabilities are more than $24 trillion and growing, which means there is a $24 trillion gap between Medicare’s future benefit costs and the future taxes and premiums it already expects to collect. Since President Obama has not submitted a plan to save Medicare, earlier this year, I voted in the House of Representatives for Congressman Paul Ryan’s budget resolution for Fiscal Year 2012. I voted in favor of this budget because I understand Americans are ready to embrace a bold path forward to ensure that our nation pays down its debt and sustains a solvent Medicare program for both you and future generations. Alcee Hastings: Ted Deutch: |

| e. What free market alternatives for Medicare are you going to support? |

Tom Rooney: Let’s start with the Ryan Plan that allows for competition in Medicare. It works a lot like Medicare Advantage where seniors can pick and choose what is best for them. That is free market.” Allen West: House of Representatives Budget Chairman Paul Ryan (R-WI) introduced the Budget Resolution for Fiscal Year 2012 (H. Con. Res. 34) on April 11, 2011. On April 15, 2011, H. Con. Res. 34 passed the House of Representatives by a vote of 235-193. I supported this resolution because I believe it is an important step to rein in out of control Federal Government spending. This budget resolution cuts $6.2 trillion in spending from President Barack Obama’s budget over the next 10 years, reduces the debt as a percentage of the economy, and puts the nation on a path to actually pay off the national debt. The budget’s reforms will protect health and retirement security. This starts with saving Medicare. The open-ended, blank-check nature of the Medicare subsidy threatens the solvency of this critical program and creates inexcusable levels of waste. This budget takes action where others have ducked—but because government should reorient its policies without forcing people to reorganize their lives, the budget’s reforms will not affect those in or near retirement, at the age of 55, in any way. Starting in 2022, new Medicare beneficiaries will be enrolled in the same kind of health care program that members of Congress enjoy. Future Medicare recipients will be able to choose a plan that works best for them from a list of guaranteed coverage options. This is not a voucher program, but rather a premium-support model. A Medicare premium-support payment would be paid, by Medicare, to the plan chosen by the beneficiary, subsidizing its cost. In addition, Medicare will provide increased assistance for lower income beneficiaries and those with greater health risks Alcee Hastings: Ted Deutch: |

| f. Why would any of the members on the commission have incentive to compromise? |

Tom Rooney: The triggers are not acceptable for either side. The Democrats do not want the Commission to end in deadlock because the trigger would be unacceptable cuts in Medicare. The Military cuts would be not be acceptable for the Republicans. Allen West: If the motivation is to think about the next election rather than the next generation then we have reason to be very concerned. Further, if President Obama and Capitol Hill Democrats believe that a “balanced” approach means advocating job-killing tax increases on the American taxpayers and small business and in return smoke-and-mirror entitlement reforms, then we have reason to be concerned. However, the Joint Select Committee’s reported legislation will be judged against the Congressional Budget Office (CBO) current law baseline, which already projects that revenues will increase by $3.5 trillion over the next decade due to across-the-board tax rate increases coming in 2013. Additionally, due to the way CBO measures deficit reduction, any reduction of these taxes would increase the deficit—the opposite of the Committee’s assigned task. For this reason, the de facto mission of the Committee will be to cut spending in order to achieve the deficit reduction directed. Alcee Hastings: Ted Deutch: |

| g. Where would you support or not support compromise? |

Tom Rooney: I would not support increasing tax rates period. I would support reforming the tax code to close loopholes that enable large corporations, for example, GE, Verizon, and others, not to pay any taxes at all. GE even got a refund Allen West: At this point in time, I cannot make a prediction on what the Joint Select Committee compromise will entail. I can assure constituents that I will look at the recommendations from the Committee and will make a decision on what I believe are in the best interest of the Congressional District and the United States. Alcee Hastings: Ted Deutch: |

| h. Speaker Boehner’s says that the commission will not be able to raise taxes. President Obama and Harry Reid said that “balance”, i.e., tax increases, is the whole point of the commission. How are these points of view to be reconciled? |

Tom Rooney: The compromise is reforming the tax code; not increasing tax rates but looking at what is unfair, e.g., loopholes that reward corporations with high paid lawyers. Allen West: In the unlikely event the Joint Select Committee was to propose tax increases without a complete restructuring led by the President of Medicare, Medicaid and Social Security , I believe House Republicans would defeat the increase on the American Taxpayer, and the automatic across-the-board sequestration of $1.2 trillion would be implemented. I will not allow Capitol Hill Democrats to use a spending-driven debt crisis to increase job-destroying taxes, especially when our employment situation is the worst since the Great Depression Alcee Hastings: Ted Deutch: |

| 3. The CBO scoring of the bill assumes the Bush tax cuts are allowed to expire, possibly accounting for all the “savings” from the bill over 10 years. | |

| What is the plan to prevent this massive tax increase on small businesses and the middle class? |

Tom Rooney: I think this is a false assumption that the Bush tax cuts will expire. I will not support this. In fact, it would be catastrophic to the economy. This could only come up after the next election, which means the Commission has to work harder to reduce spending right now . . . and we have to get our people out to the polls! Allen West: The Bush Tax Cuts were set to expire in 2010 and President Obama and the Democrat controlled Congress extended the tax cuts until 2012. The tax cuts were set to expire next year whether they were included in the Budget Control Act or not. As mentioned above, if the Joint Select Committee were to propose any tax increases, including letting the Bush tax cuts expire, I expect the House to defeat them on the floor. I will strongly oppose any effort to raise taxes, I support the Bush Tax Cuts, and I will hope that we can provide even greater tax relief on the American Taxpayer and small business owners. Alcee Hastings: Ted Deutch: |

| 4. Balanced Budget Amendment | |

| What are you going to do to promote and support a Balanced Budget Amendment? |

Tom Rooney: We are voting on a Balanced Budget Amendment in October and I am voting for it. I hope to God that it passes! This is the only hope for this country to stay great! Allen West: The Budget Control Act that I supported requires both the House and Senate to vote on a Balanced Budget Amendment to the Constitution. I ran on a platform to enact a Balanced Budget Constitutional Amendment. I support H.J. Res. 2, a Balanced Budget Amendment introduced by Congressman Bob Goodlatte (R-VA) on January 5, 2011. In fact, I was among the first cosponsors of this legislation, signing onto it on January 19, 2011. This bipartisan legislation has 240 cosponsors, and is nearly identical to a Balanced Budget Amendment that narrowly failed to pass out of the Congress more than 10 years ago. I will bring to the attention my constituents, and to the American people, Members of Congress who vote against a Balanced Budget Amendment who have supported this or similar Balanced Budget Amendments in the past. Alcee Hastings: Ted Deutch: |

| 5. We, the Palm Beach County Tea Party are committed to promoting fiscal responsibility in our governing bodies. | |

| What is your office’s agenda in the next 15 months to curb runaway spending? |

Tom Rooney: Personally, we are cutting our office budget by 20%. In Congress, I am co-sponsoring the Connie Mack Penny Proposal that basically cuts some every year to eventually balance the budget. I will also be working to get like-minded fiscal conservatives elected to the House and Senate so that we can do more than “pocket change.” We really need to take the Senate and the White House! Everything rides on this election! Allen West: I, too, as your Congressman in the House of Representatives am committed to fiscal responsibility in our federal government. President Obama and the Senate Democrats have proven that fiscal responsibility is the last thing on their agenda. The Budget Control Act is far from perfect, but the hard reality is that fiscal conservatives control only one half of one third of the Federal Government. Remember, thanks to the support of the Tea Party, we were able to change the entire debate in Washington. With the support of the Tea Party we were able to pass the Cut, Cap and Balance Act – with a bipartisan vote. But before we even voted for it, the Democrat-controlled Senate declared it “dead on arrival,” and the President promised to veto. We are dealing with an ultra Liberal White House and Senate – they refuse to acknowledge reality, and refuse to accept responsibility of the mess they got us in. The reality is that we will not get what we all know is the right kind of package that will set our economy on the proper course as long as President Obama is in the White House and liberals like Senate Majority Leader Harry Reid control the Senate. Another reality is this – the only way we will be able to bring real reform to all branches of the Federal Government is for conservatives to accept this reality we are in and unite behind a common goal of defeating Liberals in the House, Senate and White House. On April 15, 2011, the House of Representatives passed a federal budget for Fiscal Year 2012. It has now been more than 825 days and the Democrat-controlled Senate has still not produced a budget. Since January, the House of Representatives has passed six out of 12 appropriations bills to fund the federal government. The House is presently considering the seventh bill, while the United States Senate has considered and voted on only one. All 12 appropriations bills are to be considered and sent to the President by September 30th each year. Upon return from the August district work period, only 24 days will be left to finish the budget for Fiscal Year 2012. Clearly, the Senate is setting up the House to consider an Omnibus Appropriations Bill with the only alternative being to shut down the federal government. Simply put, the Senate is putting Congress on a path toward failure. I have supported each of the appropriations bills the House has considered this year because each of them makes substantial cuts to the Federal Government’s budget – each in line with what Paul Ryan’s budget has allocated for spending. I will not support any appropriations bill unless it makes substantial cuts to the Federal Government that are in line with the budget allocations of Rep. Paul Ryan’s budget. I will continue to support legislation that shrinks the Federal Government, with the ultimate goal of getting our fiscal house in order. I remain firmly dedicated to passing a Balanced Budget Amendment through Congress to be sent to the states before the end of the year. A Balanced Budget Amendment represents the best opportunity to ensure fiscal responsibility by the federal government. Further, please find an open letter to the Constituents of the 22nd Congressional District outlining the issues I believe the Congress needs to address. Most importantly, I will continue to support legislation that will help spur economic growth by creating jobs. I will continue to push the Small Business Encouragement Act – legislation I introduced that will provide a tax credit to small businesses for hiring unemployed individuals. The only way to get our economy back on track is to get Americans back to work. The reason the unemployment problem in American has worsened is because the stimulus package, burdensome regulations, and economic policies of the President that have been a failure. The President’s policies have resulted in disaster for our economy. Since Obama took office, unemployment has remained at or near 9 percent for 28 months, America has added $3.4 trillion in debt in 29 months — the equivalent of about $4 billion per day — we have an anemic housing market with record foreclosures, and an average price of nearly $4 for a gallon of gas. The House has sent nine job creating bills to Senate Majority Leader Harry Reid, Senators Dick Durbin, Charles Schumer and the Democrat Leadership, yet they have collectively decided these pieces of legislation were not even worth consideration in the first six months of Congress. Alcee Hastings: Ted Deutch: |

| Concluding Thoughts | |

|

Tom Rooney: Allen West: When I ran for office in 2010, I made it perfectly clear that a Republican House would not be able to reverse all the damage done by the Obama Administration and previous Congresses, but that it would only stop the bleeding. House Republicans passed bipartisan legislation that would solve our nation’s debt problems once and for all, the Cut, Cap and Balance Act. True to form, Majority Leader Reid and his Democrat Senate colleagues killed it in the U.S. Senate. The President and Liberal Democrats wanted a clean raising of the debt ceiling. Instead, because of voices like yours throughout the country, we were able to set the precedent for any raising of the debt ceiling to be contingent on spending cuts. The Budget Control Act ensures that: 1) we will cut spending more than any increase in the debt ceiling, 2) taxes are not increased on America’s job creators and families during these difficult economic times, and 3) both the House and Senate are required to vote on a Balanced Budget Amendment to the Constitution. The measure also places tough caps on future spending – restraining the growth of government so the economy can get back to creating jobs – while guaranteeing the American people a vote in both houses of Congress this fall on a balanced budget amendment to the Constitution. To the Members of the Tea Party: It was not everything that we wanted – but it is a first step for the future of our republic. |

|

When Will Folks Figure Out That the Federal Government Simply Does not Deliver as Promised

In spite of the federal government’s best intentions, they simply do not deliver what they say they are going to deliver. Furthermore, when they do deliver, it ends up costing 10 to 20 times what they originally said it was going to cost. In the private sector, doing this just one time would get folks fired yet we continue to empower our government to do this over and over and over again? Why? Here are just a few examples.

The United States Post Office (USPS) lost $5.7 billion during the nine-month period ended June 30th compared to $5.4 billion in the same period of 2010! In its fourth straight year of declines, the agency has a net loss of $8.5 billion for the 2010 fiscal year. In spite of the overall losses, the USPS said shipping and standard mail saw growth in the third quarter, with revenues up 7.3 percent and 1.7 percent respectively. Why is this happening? In the private sector, adjustments would be made to obviously get a handle on their costs. Why can’t the postal service do the same?

Large cost overruns are routine on federally funded transportation projects. An example is the Springfield, VA highway interchange project. This project was estimated to cost $241 million, but ended up costing $676 million. Then officials involved with the project claimed the project was completed on time and under budget when in fact the project cost 3 times what it was intended to cost. Did heads roll? —of course not.

How about the “Big Dig” in Boston. This is the underground local highway project that all of us taxpayers outside of the state of Massachusetts ended up paying for thanks to former Senator Kennedy. The Big Dig was the most expensive highway project ever to be done in America. It was plagued with escalating costs, scheduling overruns, leaks, design flaws, charges of poor execution and use of substandard materials, criminal arrests, and even four deaths. The project was scheduled to be completed in 1998 at an estimated cost of $2.8 billion. The project was not completed, however, until December of 2007 at a cost of over $14.6 billion. The Boston Globe recently stated that the project is still not completed as originally specified and that it will ultimately cost $22 billion included interest and not be paid off until 2038!

Not all federal government projects are mismanaged like the Big Dig but cost overruns and delays are routine. A government accountability office study found that half of the federal highway projects it examined had significant cost overruns in excess of 25%! And nothing is being done about this!

It goes on and on and one. Despite billions of dollars in cost overruns and years of delay, Lockheed Martin Corp and US Navy officials are hanging on to the development of a new “Presidential helicopter.” The program initially called for $6.1 billion in spending to develop and build the next generation of Marine One choppers—but the expected cost of the program is now estimated to be $11.2 billion.

In 2008, the GAO completed a review of costs and schedule of approximately 72 weapons program and found that the average cost overrun for development was 40 percent! A recent study by Deloitte Consulting agrees that defense cost overruns are getting worse.

Who is to blame—that’s an easy one—our Congress. They hold the purse strings and rather than looking after taxpayers interests, most members fight attempts to reduce spending in their districts.

These cost overruns go on forever. The Erie Canal project incurred a 46% cost overrun, the Panama Canal 106%, Hoover Dam a small 12%, Louisiana Superdome 366%, and the renovation of Yankee Stadium 317%.

The system is broken. Many times these proposed project are low-balled when they are proposed to Congress, and then after approval, it moves ahead and becomes very difficult to terminate even if it becomes an obvious boondoggle.

This kind of low-balling happens also in entitlement programs. When Medicare Part A was enacted in 1965, costs were projected to rise to $9 billion by 1990, but the costs were actually $67 billion that year! When home care benefits were added to Medicare in 1988, they were projected to cost $4 billion by 1993, but ended up costing $10 billion. When the 1996 farm law was passed, subsidies were stated to be $47 billion in total between 1996 and 2002, but were in fact $121 billion.

Now for the big one. The 2003 Medicare prescription drug bill. Bush promised that the legislation would cost $400 billion in the first 10 years, but in fact after passage, this number was immediately adjusted to $534 billion.

What is the solution? Simple—reform the procurement process and terminate or privatize as many federal activities as possible. Move state projects back to the states and get the federal government out of play, which in effect will shrink the size of government.

One more detailed example please. Amtrak ridership has increased year after year and has climbed 18 consecutive months. Yet, Amtrak’s financial losses are projected to widen this year. Amtrak officials project an operating loss of $506 million in the current fiscal year ending September 30th, up from a loss of $419.9 million last year. Amtrak officials have projected a loss next year of $616 million. This is a waste of taxpayer money. Federal subsidies cover about 16% of Amtrak’s operating expenses, which are projected to total $3.94 billion this year. How can you be serving more and more passengers yet at the same time, losing more and more money? Amtrak was created by Congress. Besides the operating subsidies, it also received recently a $450 million capital appropriation to upgraded a 24 miles segment between Morrisville, PA and New Brunswick, NJ. Why are we not pushing to open Amtrak lines to competing rail operators thereby creating some competition? All of these costs translates into American taxpaying citizens providing a subsidy of $32 for each and every passenger who rides an Amtrak train during the year which is four times the operator’s estimate-seeing a pattern here?

I could give so many more examples. I will mention just a few here—but the point is made—we must get control of this spending and these overruns—they simple are not tolerated in the private sector so why are we accepting them in the public domain.

Denver International airport—original estimate was $1.7B—final cost $4.8 billion.

Clinch River Breeder Reactor program-original estimate $400 million- final cost $4 billion

Future Gen clean coal project- original estimate $1 billion—final cost $1.8 billion

C-130J Hercules- original estimate $10.9 million- final cost $430.3 million

Extended Range Munitions- original estimate $86.8 million—final cost $ 500.1 million

Air Traffic control modernization- original estimate $8.9 billion- final cost $14.6 billion

Why would anybody in their right mind believe the Obamacare projections—or that the federal government is actually capable of curing the high cost problem in healthcare? Only a fool. The government is simply incapable as demonstrated time and time again of hitting their budgeted targets or that of the CBO—it simply does not happen. So we should as prudent and common sense people just assume that Obamacare in the end will most likely cost 10X of what is proposed. Logic and demonstrated track record here prevails. It is for this reason, that hopefully after the elections in 2012, we can again put our representatives in Washington back to work to kill this really ugly piece of legislation.

The Debt Ceiling is Raised – Now What?

Many press accounts of the debt ceiling compromise say “… the tea party won…”, and President Obama was forced to capitulate. It does not feel that way to me. For some reason, this feels as bad as the malaise that followed the passage of the Affordable Care Act. For days it seemed like the sun would not shine again.

Many in the tea party and 912 world are very disappointed in the outcome, and for some reasons that have not been widely explored. Yes it may have been difficult to get more from the divided Congress. But several aspects of the bill seem to have given the initiative for further action completely to the Democrats. The question that hangs in the air like smoke after a firefight is …. what now? What is the strategy to fend off the coming tax increases. How will the “select committee” resolve ideological differences over the role of government and fend off the “trigger” that will decimate the military?

Many tea party and 912 members worked hard to get Congressman Allen West elected, some going back to the 2008 race. We want to be loyal, we want to support him in 2012. But we really need to understand. This is some of what we need to know:

- The bill cuts about $1T over 10 years, but the reduction from planned spending over the next two years is pocket change. Since this Congress can’t bind a future Congress to a course of action, why is anything in the out years even relevant?

- The second “tranche” requires agreement of 6 Republicans and 6 Democrats, yet to be named, or else massive cuts are applied to the military budget and to Medicare providers. Since cuts of the suggested size would severely impact our war fighting capablility and leave us weak in a world of increasing danger and instability, how could this even be contemplated? And as to Medicare providers – will not cutting doctors and hospitals create massive supply disruptions that will make care for seniors difficult to obtain?

- Since both aspects of the mandatory actions on failure of the commission could be considered results sought by a majority of Democrats (based on past actions), hasn’t this bill essentially handed all the leverage over to that party? Why would the 6 Democrats on the commission have any incentive to compromise?

- Speaker Boehner’s PowerPoint charts say that the commission will not be able to raise taxes. Both Harry Reid and President Obama on the other hand, say “balance” – (meaning tax increases on “the rich”), is what they expect of the commission. How are these points of view to be reconciled?

- The CBO scoring of the bill assumes the Bush tax cuts are allowed to expire, raising taxes by several trillion, possibly accounting for all the “savings” from the bill over 10 years. What is the plan to prevent this massive tax increase on small businesses and the middle class?

- We understand that necessary changes cannot be made in one step, and that control of only the House and not the Senate and White House makes progress difficult. Accepting the premise that August 2 was a drop-dead date narrowed the range of options. That said, what leverage is remaining to the conservatives and what further steps can be taken short of defeating the President and winning control of the Senate in 2012? How do we continue the fight?

- And lest we forget, what happened to the pledge to have bills published on the Internet for a few days before a vote?

Note:

Both of our local conservative Congressmen from districts 22 and 16 voted for this bill. The Palm Beach County Tea Party is preparing a set of questions for them to help us understand their positions. Congressmen Allen West is a guest for the 8/15 PBCTP meeting and will have plenty of time to address these areas. Congressmen Rooney will also be a guest at the Labor Day Barbecue and can do the same. Watch this space.

Hear and Cheer

So is it a GOOD DEAL?

So what’s in this new “deal”?

According to the Powerpoint released by the Speaker’s office (CLICK HERE), it is a good deal. Response from both sides of the aisle have been mixed though, and most are waiting to read the real bill. They better be quick though as they will likely have to vote on it tomorrow.

Here’s what seem like good things:

- No Tax Hikes are included in the bill

- Cuts more over 10 years than the debt ceiling is raised

- Cuts and caps discretionary spending

- First “tranche” is $900B increase now, second “tranche” needs to be acted on by Congress next year

- Second “tranche” of $1.5T enacted if BBA sent to the states by year end OR joint committee cuts spending (by Thanksgiving) more than another $1.5T

- Triggers require across the board cuts if caps are violated

- According to the Powerpoint, it makes it “impossible” for the Joint Committee to increase taxes

Some not so good things (not all mentioned in the Powerpoint):

- Spending cuts are back loaded – first two years are pocket change.

- Requires 12 member bipartisan “joint committee” to agree on second round of cuts – if no agreement, automatic cuts are applied to Medicare (doctors and providers get cut – not beneficiaries) and Defense. Medicaid, Social Security, Veterans and military pay are exempt

- Powerpoint claims that committee cannot raise taxes, yet one analysis implies that the Bush tax cuts will be allowed to expire – effectively Obama’s tax on “the rich”. Will have to wait and see on that one.

So is this a good deal or not? My thought is that we may have been snookered again, just like with the continuing resolution earlier in the year. The democrats orchestrated this to be resolved at the last minute and the House will be asked to vote on it without having even a full day to consider the ramifications. Washington at its UGLIEST!

I withhold my judgement until I can read the bill. So should you.

Being a Grandparent

Being a Grandparent: I have been a grandparent for the last six years. Need I tell anyone the joys and heartaches that come with it? I do not think so. The demands, the crying, the laughs, the kisses and hugs are all a part of this wonderful journey. I did not have the benefit of my Grandparents. They passed away before we got to know one another. My dad told stories as do most families. These stories included gossip, medical remedies, tall tales and moments of courage. It is the moments of courage I remember most. My Dad and I were close but he, having raised his five kids alone, was not the typical grandparent. For me that was fine and very understandable. When I began my journey of grandparenthood I was very committed to the idea that I would take the very best of my and my dad’s life experiences and pass them on. Little did I know at the time I would be talking about the national debt. I would have talked about personal financial responsibility, i.e. saving your allowance, do not spend more than you have, do not use credit cards to get what you want unless you can pay it off the next month. Your financial profile tells a lot about who you are.

When I go on like this people say to me Janet you are forgetting a generation. What about your own kids. I say that I and most of the people of my generation spoiled our kids. We worked hard and believed it was better to make life easier for them. Unfortunately, we were wrong. We did not prepare them. They did not have the benefit of the experiences of people who lived thru the depression. I had many relatives talk about how hard it was. I sat with them and heard their stories of courage. Regrettably when I tried to repeat those stories I was silenced with the “yeh I know you walked five miles in the snow to go to school”. I did not demand they listen and learn. What can I expect of a generation that was raised in the good life. Is it their fault? There are exceptions to this and they are making their voices heard. God willing, one by one we shall all stand side by side to right this wrong.

I tell them to be concerned with the National debt. Pay attention for the sake of your children. I tell them that now because rightfully or wrongfully I am a part of a generation that has taken their future. I have to apologize to them. I have to tell them I am doing everything I can do to reverse it. I have to tell them I do not know if I will be successful.

Am I willing to cut back, stand up for what is right and quit the blame game to look for viable answers …yes. Are you? If you are, join the fight, put your boxing gloves on and fight a good fight. Win or lose, the most important lesson I can pass on to the next generation is be personally accountable for everything you say, do and how you vote.

God Bless Janet

Let The Truth Be Told

The real culprit in the current financial crisis is the current administration and the previous democratic controlled Pelosi-Reid congress. Americans need to understand (and of course with no support or help from the press) that the current debt ceiling is only a trigger on the proverbial “gun”—the gun has been the enormous spending boom of the last three years under the complete control of Obama-Pelosi-Reid. What makes matters worse is that two of the these three players and the press lack the political will to reduce spending in years to come—and are simply doing everything in their power to focus away from spending and instead muddying the water with tax revenue promotion. What a crock!

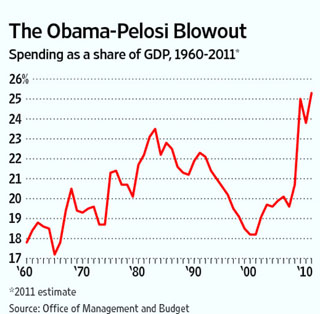

Spending is the problem and in the last three years the Obama-Pelosi-Reid regime has had an extraordinary blowout. We have not seen anything like it since WWII. Nothing even close—and no, not even during Bush’s second term. The chart below gives a graphical depiction of what we are talking about—and this should be place on every news wire day after day after day until folks can understand what the real problem is.

This chart clearly tracks federal outlays as a share of Gross Domestic Product since 1960. The early peaks represent the Johnson “Great Society” spending and then the high of 23.5% with the recession of 1982 coincident with Reagan’s defense buildup.

From this point, spending declined mostly during the 90’s when Clinton radically cut back defense spending to 3% of GDP in 2000 from Reagan’s peak of 6.2% in 1986. During George W Bush’s years spending bounced back up to roughly 20% of GDP, but no more than 20.7% as recently as 2008!

Then the Obama “blowout” in concert with his team in Congress—Pelosi-Reid! The Democrats basically blew up the national balance sheet, lifting federal spending to 25% in 2009, the highest level since 1945. Though the supposed recession ended in 2009, spending in 2010 stayed high at nearly 24%, and this year, 2011, it is heading back toward 25%.

Federal debt held by the public as a share of GDP is another interesting perspective. In 2008, it was 40.3%, then 53.5% in 2009, 62.2% in 2010 and an estimated 72% this year, and is expected to continue rising in the future—driven of course by ObamaCare. These are heights not seen since the Korean War, and many analysts think the US debt will soon hit 90% or 100% of GDP—-think Greece boys and girls!

Now, Congress, under the leadership of Pelosi-Reid was responsible for the way so much spending was wasted, resulting in little job creation and the slowest economic recovery since 1930s. In the US system however, historically, President’s are supposed to be the fiscal watchdogs. When they fail to do so, the Congress if allowed spends like they are on steroids! This is exactly what has happened.

Now, what is all ironic about this is that all of a sudden, President Obama has got religion, and is claiming to now have found “fiscal virtue.” In fact, what he is really doing is using the debt-ceiling debate as a battering ram not to control spending but to command a tax increase! Why is the press not demanding specifics from Obama on the spending side of the equation! He has provided nothing—that is fact and what little he has said about cuts in spending are negligible. The only things that I have heard is his offer for immediate domestic nondefense discretionary cuts of $2BB—a drop in the proverbial bucket!

As for Obama’s proposed entitlement cuts—nada! His vague suggestions are nibbling around the edges of programs that are growing faster than inflation—and ObamaCare—is untouchable despite its $1 trillion in additional spending over the next several years and growing faster even afterwards!

So, now the showdown over the debt limit which has to be raised to accommodate all of “his” spending. And Obama of course instead of taking responsibility for the spending and focusing on reducing it is blaming the Republicans for being irresponsible because they won’t raise taxes in return for modest future spending restraints. And people are falling for this BS and the media does not have the guts to speak the truth! What a sad state of affairs!

Call to Action: Cut, Cap, Balance Vote Tomorrow

Hello Friends and Fellow Patriots,

Tomorrow, Tuesday, July 19th, the US House of Representatives will be voting on the Cut, Cap, and Balance Act of 2011. Even though President Obama has vowed to veto this bill, it will make a statement to our country that our representatives are ready to take a stand for:

- Substantial cuts in spending

- Enforceable spending caps

- Congressional passage of a Balanced Budge Amendment to the U.S. Constitution that includes a spending limitation an a super-majority vote to raise taxes before the debit ceiling can be raised.

Please contact your Representative today to ask for him to co-sponsor and vote Yes on the Cut, Cap, and Balance Act of 2011.

Here are some facts that you can use to support this stance:

- The debt held by the public has more than doubled in just the past five years. Interest paid on the national debt is expected to more than triple over the next ten years.

- Many economists believe the US faces a Greek-style debt crisis within the next five years if we do not get our fiscal house in order very soon.

- The federal government has hit the $14.292 trillion debt limit set in February 2010. Raising the debt ceiling without significant spending cuts is simply a tax increase on future generations.

- Moody’s Investors Services has said the AAA rating of US government bonds is in jeopardy unless Congress passes “a budget that includes long-term deficit reduction.”

- Standard & Poor’s has said it will downgrade US debt if the US doesn’t 1) cut spending substantially and 2) REFORM the way it budgets, to control future spending.

- The Cut Cap and Balance Act (CCB) would meet the tests set forth by Moody’s and S&P, so we never again face this kind of debt problem. In short, “CCB=AAA.”

- The Cut, Cap, and Balance Act is a long-term deficit reduction package that will ensure we get back on the path of fiscal sanity and are not downgraded from our AAA bond rating.

For your convenience, here are the US Congressmen from Palm Beach County and their contact information. To email them directly, just click on the link after their name.

Tom Rooney (R-16)

https://forms.house.gov/rooney/webforms/issue_subscribe.html

Washington Office Tel: (202) 225-5792 Fax: (202) 225-3132

Stuart Office (772) 288-4668 Fax: (772) 288-4631

Ted Deutch (D-19)

https://teddeutch.house.gov/Forms/WriteYourRep/default.aspx

Washington Office Tel: (202) 225-3001 Fax: (202) 225-5974

Boca Raton Office Tel: (561) 988-6302 or (561) 732-4000

Allen West (R-22)

https://forms.house.gov/west/webforms/contact-form.shtml

Washington Office Tel: (202) 225-3026 Fax: (202) 225-8398

West Palm Beach Office Tel: (561) 655-1943 Fax: (561) 655-8018

Alcee Hastings (D-23)

https://forms.house.gov/alceehastings/webforms/issue_subscribe.htm

Washington Office Tel: (202) 225-131 Fax: (202) 225-1171

Delray Beach City Hall Tel: (561) 243-7042 Fax: (561) 243-7327

Thank you for taking this action TODAY!

Palm Beach Gardens City Council Mtg 7/19 – a Call to Action

Palm Beach Gardens residents should be aware of several items on the Agenda (and one that no longer is):

Ordinance 11, 2011 – not on Agenda:

Second reading of Ordinance 11, 2011 was removed from the agenda. This was the ordinance that made the change, among other things, to the election run-off process – essentially eliminating run-off except in the case of a tie. Purportedly this would save between $10000 and $40000 or so per run-off. Changes to the charter require a referendum – and so too would this change. According to Max Lohman, City Attorney – this change will be considered for the upcoming charter review, changes to which will require citizen votes. Had it been on the agenda – it would have passed and parts of it would have not have been valid without referendum. What would that have cost the city?

Ordinance 13, 2011, Increasing the Local Communications Service Tax Rate – First Reading:

This 2012 budget related item would increase the Local Communications Service Tax from its current rate of 1.5% to the maximum allowed by state statutes to 5.22% effective January 1, 2012, “on all sales of communications services within the City. These services include telephone (including cellular), cable TV, and internet fees, both residential and commercial.” This is technically a 248% increase! But it will probably be described as ‘pennies a day’!

The effects of the proposed change on two sample residents with annual communication charges of $2,400 and $3,600 are illustrated in the table below:

| Average Annual Bill | Increase in Rate | Annual Increase | Monthly Increase |

| $2400 | 3.72% | $90 | $7.50 |

| $3600 | 3.72% | $135 | $11.25 |

The adoption of the 5.22% Local Communications Services Tax is an integral component of the fiscal year 2012 budget plan, and, if approved, will allow the City to maintain the same operating ad valorem tax rate of 5.7404 mills.

This TAX is expected to bring in $1.8 million in the next budget cycle and $2.4 million thereafter. Note that if your phone, cellular, internet and cable charges go up – so too will the city’s revenue be enhanced.

While I have not reviewed the proposed 2012 budget in detail, “The total budget for all funds of $108,580,228 is $3,140,160, or 3% more than the current year’s total of $105,440,068.”

Ordinance 14, 2011 -Amending Chapter 1, General Provisions, Section 1-2, Definitions of the City Code of Ordinances to Add Five (5) Definitions to be Compatible with the New Inspector General (IG) Ordinance. – First Reading

“The drafting committee failed to include certain crucial definitions within the IG ordinance. The City Attorney has advised that without defining the following terms it will be impossible to properly evaluate any potential findings of an Inspector General investigation. Accordingly, the City Attorney has drafted Ordinance 14,201 1 in order to adopt definitions for “abuse”, “fraud”, “misconduct”, “mismanagement”, and “waste” into the City’s Code of Ordinances. Clear and unambiguous definitions are an absolute necessity in order to preserve an objective standard for evaluating any potential wrongdoing. These definitions are being recommended to each of the other 38 municipalities in the county.”

Having attended each of the drafting committee meetings – these so called ‘crucial’ definitions were intentionally left out and the subject of several months of intense debate. I consulted with the Inspector General, Sheryl Steckler about the attempt by municipalities to insert these definitions into their city codes. She replied that it has no impact or relevance on her activities as Inspector General.

Why are we adding irrelevant definitions to our ordinance and what is it costing the taxpayer in staff time and effort if it is for nothing?

Resolution 33, 2011 Adopting a Proposed Maximum Millage Rate for Fiscal Year 2011/2012 and Setting the Date, Time, and Place for the First Budget Hearing.

I read this resolution first and was going to praise the City Council on holding the millage rate flat at 5.7404, 2.719% below the roll-back rate of 5.9008 mills. NOT. They should be holding the millage flat, cut spending and NOT implement the increase in the Communications TAX.

I have not studied the 2012 budget in detail yet – however:

“Please note the following significant items related to the use of reserves:

• The planned use of $1.1 million is less than total General Fund capital expenditures of $1.2 million, and adheres to the City’s policy of using reserves for one-time expenditures.

• The planned use of $1.1 million is predicated on the increase in the Local Communications Services Tax from 1.5% to 5.22%. This will generate approximately $1.9 million next fiscal year. Without this alternative revenue, or an equivalent tax increase, the reduction in reserves would be approximately $3 million.”

We are in bad economic times – this is the time for using reserves and NOT increasing a tax (the Communications tax) that will never go down. Hold the millage flat, do NOT approve Ordinance 13,2011 and cut spending further to minimize the hits to reserves!

Additional materials can be found:

Complete 7/19 Agenda with backup documents