How Long Can We Ignore Our National Debt?

It continues to amaze me how grown men and women in Congress can continue down the path to disaster by taking no serious action on our debt issue. This has to go down as one of the most irresponsible and despicable behaviors of our President and Congress in our nation’s history. And where are the young folks who are going to have to bear this burden? They are nowhere to be seen.

A friend recently sent me an email to better characterize the recent “cuts” that Congress made. When you see the numbers it pretty much puts everything in perspective when looking at our spending problem—and THAT is the problem—yes, federal revenues are down due to an impotent growth strategy (s) that the current administration is promoting, but the real problem is spending. We all know this clearly.

Here are the numbers for this fiscal year:

US Tax Revenues: $2,170,000,000,000

Federal Budget: $3,820,000,000,000

New Debt: $1,650,000,000,000

National Debt: $14,272,000,000,000

Proposed Budget Cuts $38,500,000,000

Now just remove eight (8) zeros and pretend this is your family budget to get a real feel for how our gutless Congress and President acted a few months ago in “cutting” spending.

Annual Family Income: $21,700

Money the Family Spent: $38,200

New Debt on the Credit Card $16,500

Balance on the CC $142,710

Total Budget Cut $385

So you see, the budget cuts that were made are actually far less than the debt service even on the new debt on the credit card for the year—not to mention the debt service on the total outstanding balance. Would we get away with running our family budgets this way? Why should our elected officials get away with managing “our” money this way?

Let’s take a look at our total debt– $14,587 trillion (it is actually higher than reflected above in the numbers). This can be divided into public debt, that is, the Treasury securities held by individuals, financial institutions, and foreign governments AND the intra-government debt, the sum of Treasury bonds held by agencies of the federal government, principally the so-called Social Security Trust Fund. The liabilities represent the future pensions, health care, social security payments, etc that are promised under current legislation—both are REAL obligations.

The split between public debt and intra-governmental debt is $9.924 trillion and $4.666 trillion respectively. This is over 300 million times the country’s median household income! Stacked as dollar bills, it would reach 920,953 miles high, almost four times as far from Earth as the moon. The real issue here is the debt’s size relative to gross domestic product—what this is saying is no different than the way we individually measure our own debt. Translated, it is our personal debts measured against our income. The GDP of the US was $15 trillion at the end of the first quarter in 2011. This translates to making our public debt at 66.1% of GDP and the intra-governmental debt at 31.1%. Total debt is now 97.2% of GDP and growing!

The scary part is of course the size but the scarier part is the rate of growth. For example, our debt in 1946 was $269 billion and 14 years later in 1960 it was $286 billion. The economy during these years grew rapidly so that in 1960, the debt was only 58% of GDP.

In the 1970’s under Paul Volcker as Fed chief, the debt began its soaring. Why? Quite simple—Washington continued to increase spending faster than government revenues increased (Note: revenues increased a huge 99.4% in the 1980’s). The debt was 58% of GDP in 1990, a full 24 percentage points above its 1980 lows. It continued to increase dramatically in the early 1990’s under President Bill Clinton reaching 68% of GDP in 1994.

But, Newt and the republican Congress came into power, and represented the first time the Republicans controlled both houses of Congress since 1954. In the next six years, while revenues increased 61%, federal outlays increased ONLY 22%! As a result, the debt relative to GDP declined between 1994 and 2000 to 57% from 68%–and in 1998-2000 actually showed the first surpluses in the federal budget in over 30 years. I have written about this before—it was not due to Bill Clinton’s policies—it was due to the republican controlled house under Newt Gingrich-and their ability to cut spending—and move Clinton to the center. That is fact!

In 2001 following the collapse of the dot com bubble and rising unemployment, the 2003 debt to GDP ratio had risen to 61.7% Many did and continue to blame the Bush tax cuts for this however, that is simply wrong. As I have written many times in the past—when you cut rates, tax revenues actually increase because companies and individual entrepreneurs go out and invest, create jobs, and more jobs and healthier economies produce more wealth, which in turn generates more tax revenues. This is exactly what happened after the Bush tax cuts were put into place. Federal revenues before the Bush tax cuts were put into place declined 12% in the early part of the decade, but when the tax cuts were implemented in 2003, the economy began to grow strongly and federal revenues in the next four years grew by a staggering 44% while unemployment fell to 4.2% from 6.2%. Federal outlays increased during these years by a meager 26.4% and debt-to GDP ratio increased to 64.8% by 2007, which was below what it had been in 1994 (read this Mr. Obama and Nancy P, and Harry R).

In 2008, the debt-to GDP ratio soared to 67.7%. A year later, under President Obama, it took another leap to 84.4%, a year later to 93.8% and it is headed real quickly to 100%.

No one expects to pay off our $14 trillion debt, but we do expect our government officials to get a handle on our debt issue and put into place a comprehensive spending cutting plan that will get our debt- to –GDP ratio back down to historic levels. Specifically, they must not only stop the rate of growth, they must reduce the rate of growth over the next ten years. I have represented in the past that we should have a debt plan to reduce our debt by $1 trillion/year for the next 10 years!

This can ONLY happen if the American electorate sends a solid message in November 2012 and do exactly what they did in November of 2010. This is our system—this is our way to effect “change”.

Smart Meter???

There is continual interest, speculation and concern surrounding Smart Meters and Smart Meter Grids. The first Florida community to resist the implementation of Smart Meters that I have heard of is Lakeshore Neighbor’s Association, Lakeland, FL. I have not yet received the results of their August 15, 2011 6:00pm meeting at City Hall. I will post updates. The purpose of this post is to invite dialog and provide resource information.

Florida Power and Light provides web sites www.fpl.com/energysmartflorida and www.fpl.com/contents/privacy_policy.shtml. These sites will suggest that there are benefits including improving the efficiency of meter reading and billing, increasing the quality of customer service by eliminating the need for estimated bills, saving staff time and fuel, preventing recording errors and minimizing the need for personnel to go on the property.

The privacy concerns from citizens are denied by FPL. They will tell you they only monitor how much electric you use, not how you use it. When I asked them how they interface with Grid Glo I was referred to a supervisor. I am still waiting for a reply. I urge you to research gridglo.com. The company is located in Delray Beach, Fl. According to the web site, utility companies are rapidly installing smart meters resulting in massive amounts of data being gathered. Grid Glo assigns an EPM score, (Energy People Meter) which is a real time digital fingerprint of people’s energy use.

Web sites opposing Smart Meters continue to grow. Concerns over violations of our fourth amendment persist: www.stopsmartmeters.wordpress.com and www.refusesmartmeter.com. You can also contact florida@bansmartmeter.com for local information.

To date FPL has not addressed the health concerns. What are the risks from the microwave radiation are detailed by Dr. Zory R. Glaser Ph.D. www.zoryglaser.com and “The Sage Report sagereports.com/smart-meter-rf . Excerpt from the Sage Report *the reflectivity of polished metal surfaces is usually quite high (such as stainless steel and polished metal surfaces typical in kitchens.

In my next post I hope to have the answers to:

Do Smart Meters have a second antenna that will eventually talk to my appliances? Will my washer and refrigerator report me? Use www.govtrack.us and read bill S398 Implementation of National Consensus Appliance Agreements Act of 2011, HR 2208 Smart Grid Advancement Act of 2011 and HR 2748 Smart Electronics Act.

Are Smart Meters UL (Underwriters Laboratory) listed and certified? Of the people I have talked to they do not see the UL tag on their meters.

Some Smart Meters are being installed with prior notice to the home owner and some meters are installed without any prior notice. In my next post I hope to have photo examples of both. If you search google you can see the different types now available. Ask your family and friends to look at their own house and submit pictures.

Additional Resources:

www.augustreview.com/issues/technocracy

Note: If Safari does not bring you to these sites try using Firefox or Crome.

Many thanks to those who attended America Supports Israel

We thank all the patriotic Americans who marched with us last night at our America supports Israel parade. Many members of The Palm Beach County Tea Party and the 912 Party attended. Speakers included Pastor Bray of the Christ Fellowship Church and Luis Fleischman of the Jewish Community Relations Council. A special thank you to Christ Fellowship for their kindness and generosity.

With Love & Appreciation

Barbara & Mel Grossman & Ellen & Terry Brady

Pictures from Fred and Ed:

[slide]

Heritage Congressional Scorecard

Heritage Action for America, a sister organization to The Heritage Foundation, produces a congressional scorecard for all Senators and Representatives, based on the bills they sponsor as well as how they voted on those bills of particular interest to conservatives.

In the most recent scorecard, there were 19 Senate bills and 30 House bills tracked. Of our local delegation of 5 Congressmen and our US Senators, Marco Rubio garnered the highest score of 93 (of 100), followed by Allen West with 74 and Tom Rooney with 63. The Democrats were far behind with Bill Nelson and Alcee Hastings tied at 10, Ted Deutch at 7, and Debbie Wasserman Schultz bringing up the rear with a score of 4 out of 100.

All the scores for Florida can be found at Heritage Action for America. Click on the names of the Congressman to see how they voted on the relevant bills.

Marco Rubio’s votes aligned with Heritage on 18 of the 19 bills. The one where he differed was “S2-1011, Undermine Ability of Senators to Block Unanimous Consent: Change the rules of the Senate to undermine the ability of Senators to prevent legislation from passing by unanimous consent (i.e., eliminates so-called “secret holds”).” He voted yes.

Allen West aligned on 23 of the 30 House bills, differing on H103, H143, H384, H555, H633, H677, and H690. The last two were involved with the debt limit increase deal which the Congressman supported but Heritage did not.

Tom Rooney aligned on 20 of the 30, differing on H103, H143, H179, H275, H384, H424, H455, H491, H677 and H690.

Click on the bill numbers for the Heritage explanation of the votes.

Unpublished Letter to the Editor of WSJ

This letter was not published by the Wall Street Journal so we are publishing it here on our we website. It is a very well-stated list of concerns about the Debt Ceiling legislation:

Dear Editor:

What is the reader to believe? Paul Ryan’s “Where’s Your Budget, Mr.President?” (Aug 3) fairly asks the president that question as the president and the Congress have pushed huge new costly programs like ObamaCare but they have not produced a budget to pay for them. This budget deal they passed doesn’t cut anything that can be measured and adds at least $7 trillion to the debt. Ryan says that Republicans passed a bill that “cuts more than a dollar for every dollar it increases the debt limit, without raising taxes.” And that Republicans “won the policy debate by securing the first of many spending restraints…” to avoid calamity. Excuse me, but if there is a $2.4 trillion increase in debt this year and much more in the next few years, how can Ryan make those claims? You can’t call many $trillions in new spending (debt) a tax cut! If Ryan can point to any cuts at all they are not from current spending but from cuts in projected increased spending. We are not being treated honestly by the professional politicians or the media.

And the “Super Committee” created in this bill will surely have as their focus ways to increase taxes without having to go through all the trouble of full debate as our Constitution provides and we, the people, are entitled to expect. Whatever they come up with will be offered on a take-it-or-leave-it basis on an up or down vote.

The WSJ and others call this a victory for the TEA parties? This bill being called a victory is the exact opposite of what the TEA parties have expressed in all of our actions all over the country for three years, at least. Cut, Cap and Balance has been our appeal to our elected officials, our representatives, and we got no cut, no cap and not anything near a balanced budget.

George Blumel, Atlantis FL 33462

September 13th Wellington Meeting

Join us for the next meeting of the Palm Beach County Tea Party’s Wellington Chapter, with keynote speakers Mark Meckler and Dawn Wildman, National Coordinators, Tea Party Patriots. Mark and Dawn will share with us their insights on the national tea party movement and what we can do here in Palm Beach County to make a difference in 2012. Question and Answer session to follow their speeches.

DATE: Tuesday, September 13, 2011

TIME: Doors open at 5:30 PM, Buffet at 6:00 PM ($15, Cash Bar); Meeting at 7:00 PM

PLACE: Binks Forest Golf Club, 400 Binks Forest Drive, Wellington, FL 33414

It is important to give Binks an accurate number of attendees. Please click here to RSVP with name and number of buffet and/or meeting attendees: RSVP

Directions to Binks Forest Golf Club

September 12th Boca Raton Chapter Monthly Meeting

MEETING NOTICE – Boca Raton Chapter

Join us for the Monday, September 12th meeting of the Palm Beach County Tea Party’s Boca Raton Chapter, with keynote speakers, Mark Meckler and Dawn Wildman, National Coordinators for the Tea Party Patriots. Mark and Dawn will share their insights into the national tea party movement and how the Palm Beach County Tea Party members can make a difference in 2012. Q&A will follow their talk.

DATE: Monday, September 12th, 2011

TIME: Doors open at 5:30 PM, Buffet at 6:00 PM ($15, Cash Bar); Meeting at 7:00 PM

PLACE: Boca Greens Country Club, 19642 Trophy Drive, Boca Raton, FL 33498-4633

RSVP: Boca Greens Country Club is a gated community. Click here to RSVP with name of each attendee: RSVP. Please specify buffet and/or meeting.

For More Information

Email

Call: 561.302-1479

Palm Beach County Tea Party

PBC Charter Review – Call to Action – Deadline August 26th

Back in June, the County began public meetings about its ongoing Charter Review. If you recall – the County Charter is its ‘constitution’ and describes Home Rule. There are 20 Home Rule or Charter Counties in Florida. Palm Beach County does not have a formalized Charter Review process, and this is the first comprehensive review to have taken place.

The Charter and the county’s charter review website can be found here. While there are a few changes that the Commissioners would like, citizens can input their own suggestions via the County Website. Suggestions are limited to 300 words per suggestion. Here is a link to the survey page. You can make as many submissions as you like.

Personally, I am not in favor of a few changes favored by several of the Commissioners – a) changing the county commission makeup to include a few at-large commission districts, and b) to have non-partisan elections for County Commissioners.

I have a few changes that I am submitting in order to make for better governance without bogging down the document or specifying so much detail that the slim charter becomes unmanageable. You may have others. If you would like to submit any of the ones listed below, just click on the [copy] to the right of the suggestion you would like to copy, and then cut/paste from the text that comes up and submit that to the survey link above. Each of my submissions are shorter than the 300-word limit per submission.

Friday, August 26, is the last date on which submissions will be accepted on the county website.

Review all boards and advisory committees every four years

Objective: Formalizes a review process to remove unnecessary, redundant, or obsolete Boards and Advisory Committees.

Precedent and wording from Broward County Section 2.09 F

The County Commission shall adopt procedures to provide for the review of the performance of all Boards, Committees, Authorities and Agencies at least once every four (4) years. As part of its review of the respective Board, Committee, Authority or Agency, the County Commission shall determine, by resolution, that the applicable Board, Committee, Authority, or Agency is needed to serve the public interest, and the cost of its existence to the citizens and taxpayers is justified. The review provision shall not apply to any Board, Committee, Authority, or Agency established by this Charter.

County Version of Smartcap (this is a TAB proposal)

Objective: Limits spending growth to population growth and inflation formula

Reference: State Revenue Limitation (CS/SJR958). The yearly adjustment factor is calculated based on the previous year’s cap, not revenue collected. This avoids the problem encountered by Colorado “TABOR” which caused excessive reductions in spending during an economic downturn.

Precedent: Brevard 2.9.3.1(a): http://www.brevardcounty.us/countycharter/charter-article2.cfm – s29 and City of Jacksonville Sections 14.08/14.09: http://library.municode.com/index.aspx?clientID=12174&stateID=9&statename=Florida

Suggested wording: 1) For each budget year, county revenue collected is limited by the state computed adjustment factor defined in CS/SJR958. 2) Exemptions are allowed for unfunded mandates and certain other classifications of spending. 3) Emergency override is permitted with a super majority vote of the BCC.

Periodic Mandatory Review of the Charter by Independent Commission

Objective: Formalize the review of County Charter, instead of the ad hoc approach being taken during the current county review.

Precedent: 16 of the 20 Home Rule counties have a formal appointed* Charter Review Commission specified in their Charters. Period ranges from every 4 years to every 10 years. Size of Commission ranges from 10-15 individuals, with majority or 2/3 vote required to bring an amendment forward, and most scheduled to coincide with General Elections. *Sarasota County has an elected Charter Review Commission

Recommendation: Modify the charter to require a Formal review, by appointed review commission consisting of citizens, with an odd number of commissioners and majority vote, every 8 years, with results to coincide with a general election.

Debt Policy

Objective: Transparency and Accountability

Precedent: Charlotte County Sec 2.2.J

http://library.municode.com/index.aspx?clientID=10526&stateID=9&statename=Florida

Text from Charlotte County:

The county commission shall adopt and review annually, prior to April first of each year, a debt policy to guide the issuance and management of debt. The debt policy shall be integrated with other financial policies, operating and capital budgets. Adherence to a debt policy helps ensure that debt is issued and managed prudently in order to maintain a sound fiscal position and protect credit quality. Elements to be addressed in the debt policy shall include:

(1)The purposes for which debt may be issued.

(2)Legal debt limitations, or limitations established by policy (maximum amount of debt that should be outstanding at one time).

(3)The types of debt permitted to be issued and criteria for issuance of various types of debt.

(4)Structural features of debt (maturity, debt service structure).

(5)Credit objectives.

(6)Placement methods and procedures.

State of the County Quarterly/Annual Report

Objective: Transparency and Accountability by the administrative branch of the county

Precedent: Broward County 1.04 L: http://library.municode.com/index.aspx?clientID=10288&stateID=9&statename=Florida

Lee County: 2.3.A.1.(a): http://library.municode.com/index.aspx?nomobile=1&clientid=10131

The County Commission shall require and the public is entitled to have access to a Management Report published by the County Administrator, and made public on a quarterly basis, detailing the performance of the County government offices, divisions and departments. The Management Report shall include, but not be limited to, a report on the receipt and expenditure of County funds by each County office, division and department, and a report of the expected and actual performance* of the activities of each County office, division and department.

*Performance shall include measurements (benchmark metrics like head counts against peer counties) in key areas/contingent liabilities for long term union contracts and capital projects/annual market comparison of salaries and benefits (peer counties and private sector), other issues.

Redistricting – Incumbent Protection or Citizen Input? You decide.

Fred and I attended the Florida Redistricting Public Meeting conducted at Florida Atlantic University in Boca Raton today, August 16. We didn’t know quite what to expect – eg. who would be attending, or to whom we would be addressing our comments. As it turned out, the majority of the speakers were from various interest groups, with the League of Women Voters being the best represented, as well as the most aggressive about their issues. The committee consisted of a panel of 40 state representatives and senators, arranged in a double row facing the crowd. The chairman is Senator Don Gaetz, R-Niceville.

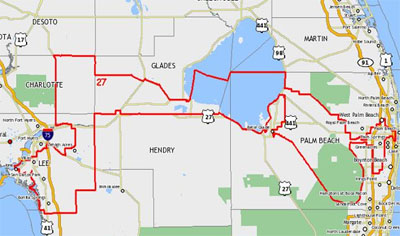

Senate 27 – a district likely to change

Both George Bennett of the Palm Beach Post, and Anthony Man of the Sun-Sentinel did a good job representing the gist of the meeting. However I’d like to capture a few of my personal observations and concerns.

First – it alarms me greatly whenever, as a political conservative, I find myself agreeing with most of the comments made by the very liberal Boca crowd who took the time to get organized, come out in force, speak and stay until the end of the meeting listening to others’ comments.

– Timeline: I agree with the concerns, best expressed by Supervisor of Elections Susan Bucher, that the timeline to completion of the redistricting effort is extremely late in the election cycle. Incumbents and those who are considering running for office will not know the boundaries or district makeup until well into 2012, which will not allow those non-incumbents to campaign or solicit donations, or even file for office. Ms. Bucher should have been allowed much more than the 2 minute (doubled for her) allotted time to express the issues as she saw them. At the end of the meeting, her issues were dismissed by Rep. Stephen Precourt, R-Orlando, the vice chairman of the House Redistricting Committee. He said that most county election supervisors said that the information would be there in plenty of time for proper preparation for upcoming elections. He cited Seminole County (population 423,000) as an example. The population of Palm Beach County is 1,320,000 – considerably larger. – Advantage: Incumbent?

– No Florida Legislature proposed maps were presented for public comment: The rationale given was that the panel would solicit public input, and then use that input (along with maps submitted by the public) to devise new legislative boundaries. But three months of public meetings throughout the state dedicated to input prior to seeing any official maps, while only allowing a fraction of that for future public comment on the official maps, only in Tallahassee, sometime in the future, smacks of self-protection by incumbents of either party. (It is too similar to what is happening on the national level where our President or the Democrat party refuses to present a serious budget.) Once a redistricting plan is out there – it is immediately subject to criticism and attack. So why not take the safer route and not present anything until the last minute. Advantage: Incumbent?

– Perceived arrogance by the legislative panel: At least one representative was not in his seat for the bulk of the meeting. Another key leader seemed to get up and leave frequently, cell phone in hand. This is a common occurrence by our elected officials at County Commission meetings. Apparently it also is common practice at higher levels of office. We had to remain seated, if we wanted to ensure our turn to speak. Please do us the courtesy of remaining in place to hear us out. We think the Republican Majority in Tallahassee is doing good work, but we also remember it was arrogance that brought down the 2006 Congressional Majority. Think about it.

I am not one of the 70+ percent of the voters who voted FOR amendments 5 or 6. I believe that there is a clear agenda behind those two amendments and that there will possibly be valid cases against these in the courts. However, as several proponents of the measures said at the meeting, Redistricting is one of the most important roles of this Legislative session in Tallahassee, and I’d feel better served if I felt that my Tallahassee representatives were looking out for my interests as a citizen, rather their own.

One last point – the purpose of redistricting is to balance the districts to reflect the 2010 census. The overwhelming majority of the speakers were more concerned with the ramifications of the Fair Districts Amendments, as if they could be used to redraw the districts on a blank sheet of paper and “right the wrongs” of the past 100 years. It would be a mistake to attempt such a thing, full of unintended consequences. Redistricting works best when adjustments are made on the margins of existing districts. We hope both sides remember that.

Ruby Red Tape- A Case study in the costs of regulation

An article below appearing in the Opinion section of the Wall Street Journal in August 16, 2011 edition is worthy of reading and understanding what Allen West said last night at the Palm Beach County Tea Party meeting. The current administration has so many barriers in place to constrain businesses from investing—the EPA’s environmental impact statement process is tantamount to putting shackles and handcuffs on private sector investment. We as citizens are paying for this—and can you only imagine the impact this has on job creation? You multiply this Ruby Red Tape scenerio by thousands upon thousands of proposed projects in the US and it does not take a rocket scientist to see why we continue to be in recession and it is almost impossible to break out!

See Ruby Red Tape for the article.